Introduction to CFO dashboards

What is a CFO dashboard?

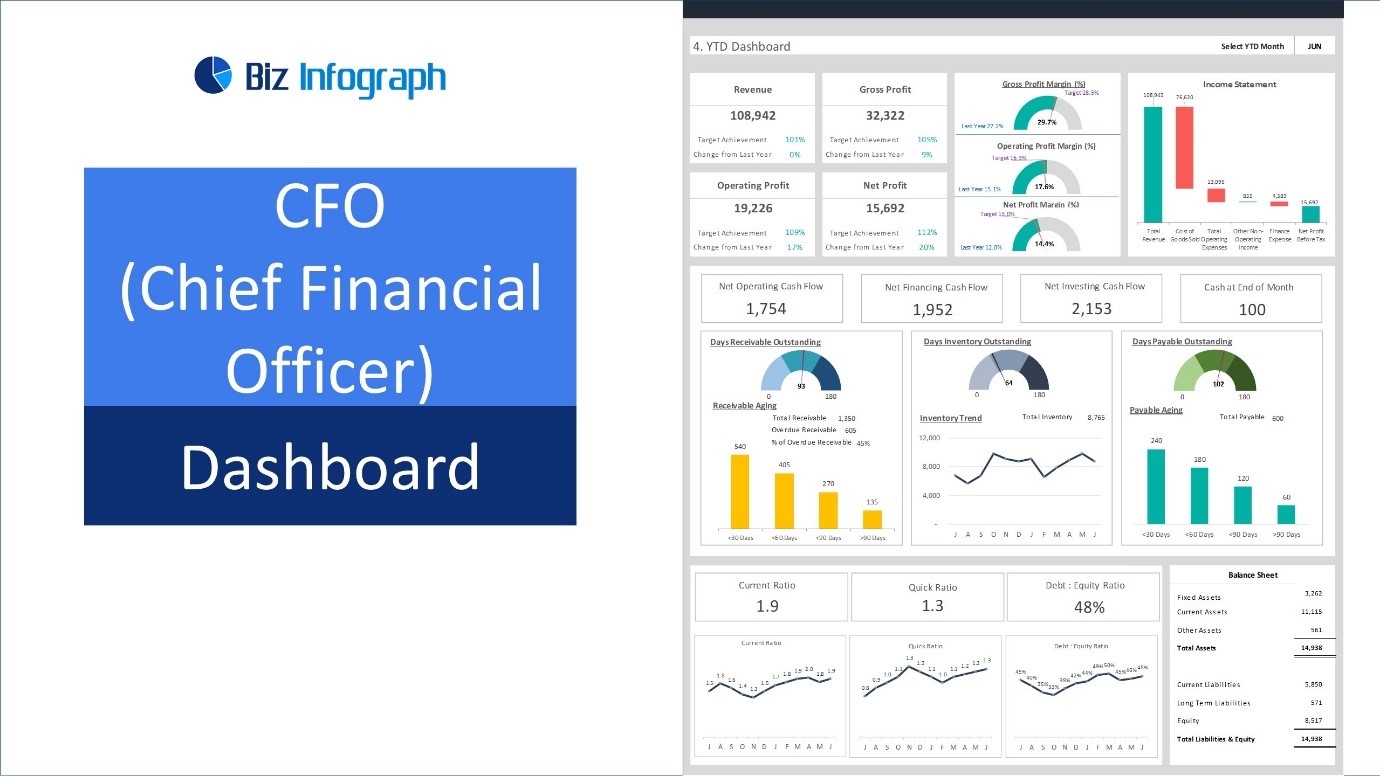

A CFO dashboard, also known as a financial dashboard, can be described as a solution that creates more accessible methods of comparing business finance data. It would be up to a CFO or a Finance Director to analyze such data and develop solutions to avoid or solve future problems. CFO Dashboards: Streamlining financial oversight and strategy for chief financial officers.

The CFO dashboard is an electronic reference instrument containing all balances and a way of keeping everything on display. This includes company cash flow, revenue, costs, etc. Advanced software and CFO dashboard templates provide customized analysis.

The Shift Toward data-driven Financial Management

The change towards using data in managing the company’s finances incorporates analytic tools to improve decision-making. The use of computers in processing large volumes of financial data results in a better understanding of trends and their area of application in planning and deciding on the efficiency of actual financial resources, thereby increasing the effectiveness of business management.

Critical Components of a Successful CFO Dashboard

Financial KPI’s to monitor

These KPIs measure how effectively a company uses investors’ capital, including cash.

Return on equity: This reveals to what extent investors’ and business owners’ funds are efficiently utilized to generate profit. Return on equity = net income/shareholder equity value.

Cash runway: It determines the cash expenditure your company makes in a week to forecast the number of weeks it would last without further capital investment. Cash runway = current cash balance/burn rate

Days payable outstanding (DPO): This shall depict the speed of accounts payable in days. Higher DPO can indicate accepting the right level of care suppliers offer and retaining more cash to present a solid working capital. However, taking ratios too high may indicate to outsiders that you need more cash to clear your bills. Days payable outstanding = (accounts payable x days in the period) / costs of goods sold)

Days sales outstanding (DSO): This shows how efficiently you recover cash from the customers in working days. A low digit means you are being paid on time. The caution: Are you losing sales because you provide too little or low-quality credit? Days sales outstanding = (average accounts receivable in the period/credit sales made in the period) × no. of days in the period

Integrating Real-Time Data Streams

Real-time dashboards will not help if your business data does not interchange between the platforms in real-time. Real-time dashboards can be obtained from systems integration as they connect different standalone systems and applications. One of them is that they help eliminate data segregation by presenting multiple facets of an organization’s performance. If the integrations are not set correctly, the dashboard will be defunct or provide an incorrect instance or only a part of the instance’s data.

Synchronization, therefore, comes with some difficulties like compatibility problems, data format differences, and the integration of two real-time feeds. To these, you require a systems integration platform, and it is most preferable if an outsourcing specialist facilitates it. These solutions will allow for an easy ‘roll forward’ into the fully integrated system that will allow the use of real-time dashboards.

Benefits of using CFO dashboards

Enhanced financial visibility

CFO dashboards offer a bird’ s-eye view of the subject organization’s financial status by condensing information from multiple sources into a simple and convenient format. Starting with revenue and expenses or moving to cash flow and profitability, dashboards provide CFOs with instant access to critical financial data, allowing for quick evaluation of performance indicators with clear areas for improvement.

Improved Accuracy in Financial Forecasting

Using a CFO dashboard makes financial forecasting more precise since it helps centralize real-time information, creates a good visualization, and recognizes peculiarities. This helps provide accurate expected values, improve company strategic planning and simulation, and make necessary interventions promptly, improving a company’s financial position and risk management.

Streamlined Reporting Processes

Conventional preparation of financial reports entailed collecting, analyzing, and presenting data, which was time-consuming and costly. The CFO dashboards polish divergent finance concerns to perform these tasks with the comfort of one or two clicks for generating specific reports. The CFO can free a lot of time for analysis and decision-making since the reporting cycle is easy.

Implementing a CFO Dashboard

Essential Steps for Deployment

Implementation of CFO dashboards includes:

- Identification of required performance measurement indicators,

- The suitable software applications, linking e.

- Link in data, design of the dashboard view, and user.

You should implement acquisition and ownership of data, quality control, and check for improvement as well as follow-up and maintenance to promote utilization and continual improvement of the financial information.

Overcoming Common Implementation Challenges

Several generic problems relate to the practical implementation of knowledge management systems; these include Inadequate information integration, lack of proper user training, and resistance to change. Proper organizational and communication skills and feedback testing techniques can fix technical problems with the dashboard and harmonize it with organizational objectives to increase its value.

Best Practices for Maintenance and Updates

To support the identified maintenance and update activity for the CFO dashboard:

- Set up standard review schedules to ensure the data is current and appropriate.

- Oversee the extensive system’s operations and the end-users to check for necessary enhancements.

- Revise the content of the dashboards when business requirements or financial statistics change.

Data versioning practices and backup solutions are measures that should be put in place to prevent data loss and enhance business continuity. For successful implementation and usage of the system, they should ensure that the users are trained on the new additions to the system.

The future of CFO dashboards

Emerging Technologies and Their Impact

In previous years, big data, AI, and machine learning technologies have disrupted CFO dashboards by offering forecasts, real-time data processing, and decision support. Such improvements make forecasting more effective, simplify financial operations, and provide a broader vision of solutions, which defines strategic and flexible monetary management in the future.

Predictive Analytics and Machine Learning

They are the key enablers that augment the CFO dashboards by providing and applying advanced analytics methods that allow the prediction of the CFO’s figures and risks in the future. These technologies use past data to gain insights, complete repetitive tasks, and increase the reliability of financial forecasts, allowing organizations to focus on critical decisions and prevent negative trends in economic performance.

Evolving Role of CFOs with Advanced Dashboards

Sophisticated dashboards are changing the very nature of the CFO’s position by delivering more affluent, real-time analysis of financial information. Instead of merely reporting, CFOs can now think about how they will contribute to the organization’s strategy formulation and increase its value. These tools help with strategic actions, risks or opportunities, and strategic alignment of financial plans and objectives.

Conclusion

Biz Infograph’s CFO dashboards are critical tools for strengthening the already important finance function, providing timely information, and ensuring better decisions. They help CFOs regarding their job as planning, including risk assessment, and not simply as reporting.

In the future, due to the use of advanced technology tools, real-time CFO dashboards, predictive analytics, and machine learning techniques will improve more aspects of financial strategies and operations. Thus, regularly following these tools will be useful for keeping up to date and maintaining a competitive advantage.

Sign up for our Daily newsletter

We'll be in your inbox every morning Monday-Saturday with all the day’s top business news, inspiring stories, best advice and reporting from Entrepreneur,